As we seek to help the region navigate the economic disruption, we have insights into new economic and qualitative data to share with you.

On September 17, the Florida Department of Economic Opportunity released August 2021 employment data that showed continued recovery for the region. The monthly jobs report combined with other sources reveals an increase in business activity while feedback directly from Partnership investors adds color to data on current hiring trends in the Orlando region (Lake, Orange, Osceola, and Seminole Counties).

Summer Spending Surges

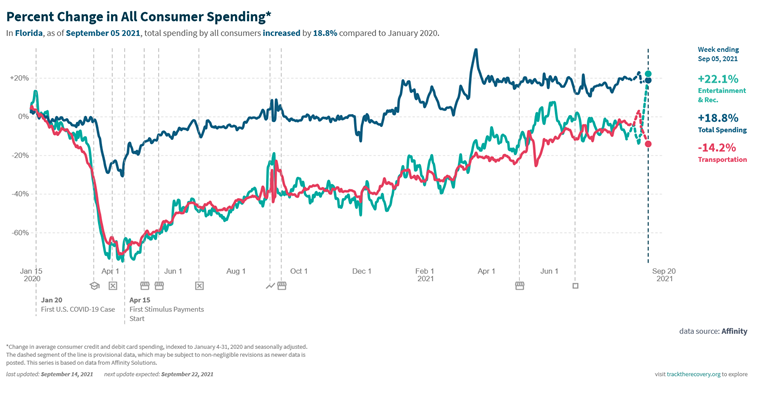

Consumer spending in the region has skyrocketed during the summer months, bringing statewide entertainment and recreation spending above January 2020 levels for the first time in over a year. Data from Opportunity Insights Economic Tracker shows that overall consumer spending in Florida is 19 percent above a pre-pandemic baseline (as of September 5) and entertainment and recreation spending (i.e., museums, arcades, movie theatres, attractions, etc.) is up 22 percent from the same reference point. Restaurant and hotel spending shows a summer surge as well, currently displaying spending levels at 23 percent above a pre-pandemic baseline. Not surprisingly, domestic travelers through Orlando International Airport reached pre-pandemic levels at the same time.

The only industry where spending remains persistently low is transportation. While levels have improved greatly since the onset of the pandemic, local transportation spending remains 14 percent below a pre-pandemic baseline, likely due to the persistence of remote work. See Figure 1 below.

Figure 1 – Consumer Spending in Florida by Industry

Employment Gains

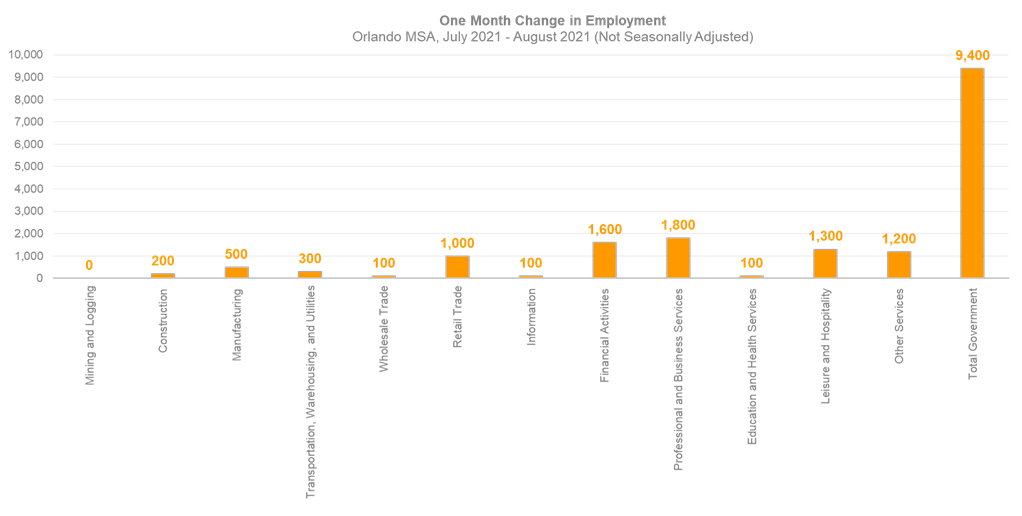

Expected summer trends appeared in job data as Government (mostly local government) hired 9,400 people from July to August. These summer hiring surges at the local level can be attributed to K-12 public school teachers and faculty being re-hired after summer vacation. Government hiring included, the region gained 17,600 jobs in the last month. No major industry lost jobs and 1,000 or more jobs were added per industry in Retail (1,000), Other Services (1,200), Leisure & Hospitality (1,300), Financial Activities (1,600) and Professional & Business Services (1,800). See Figure 2 below.

Figure 2 – One Month Change in Employment by Industry

Source: Florida Department of Economic Opportunity

This brings Orlando within two percentage points of full employment recovery in six major industries including: Government, Education & Health Services, Other Services, Wholesale Trade, Financial Activities and Construction. Nationally, Construction, Professional & Business Services and Financial Activities have already reached pre-pandemic levels of employment.

Implications for Hiring and Talent Retention

While summer spending and employment gains brought the region closer to expected, pre-pandemic levels of activity in many aspects, labor force data are signaling more of a new normal for hiring trends and talent recruitment practices. In the month of August there were 30,000+ online jobs posts open in the region, a 26 percent increase from the same month in 2019. Meanwhile, the labor force remains 2.3 percent smaller than it was during the pandemic, equating to roughly 31,000+ people who are missing from the workforce.

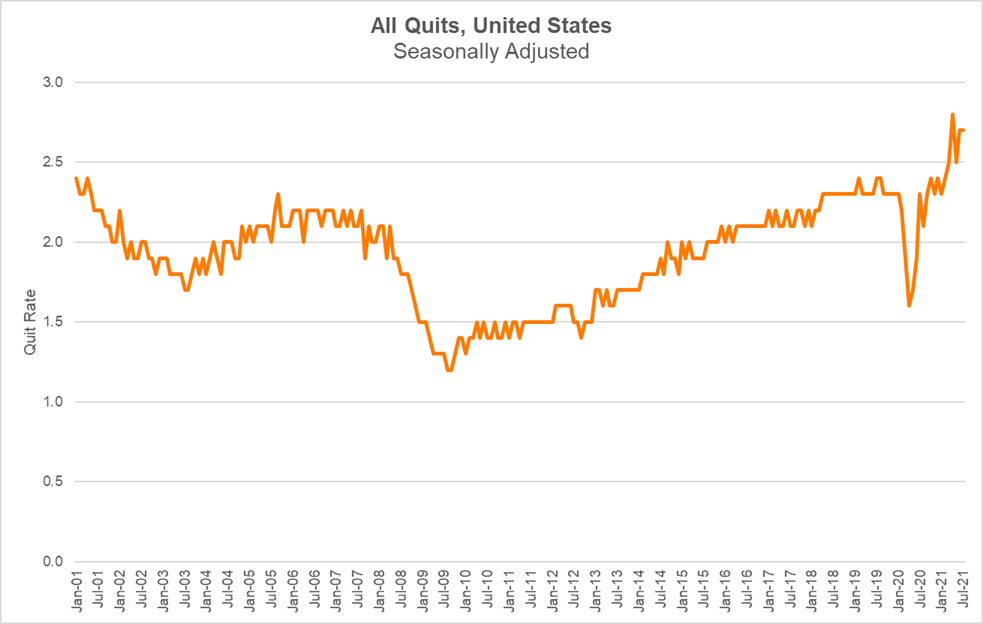

This is not to say that, if exactly 31,000 people re-entered the labor force, every job would be filled overnight. It’s very likely that job posting activity is more elevated than the numbers show given that the data only captures positions posted online. Additionally, many of these positions are open because people who kept their jobs during the pandemic are now looking for new opportunities. The U.S. quit-rate is the highest it has been in 20 years. Measuring the number of quits against total employment, this current quit rate reveals that employees feel good about their prospects in the job market. See Figure 3 below.

Figure 3 – United States Quit Rate

Source: Bureau of Labor Statistics, JOLTS Survey

The Partnership’s Talent Ecosystem Working Group, chaired by Travel + Leisure’s Kim Marshall, shed light on these trends and the current challenges retaining talent in the region during their last meeting. A group of top workforce strategists representing local businesses in finance, travel, aerospace and defense and management consulting noted that:

- Technology-dependent occupations are experiencing the most acute threats to retaining talent except for those in the aerospace and defense sector. A representative of the financial services industry shared that every exit interview with departing talent revealed that employees were solicited for the new position without a predisposition to leave.

- Diverse talent is being poached at astronomical salaries.

- Talent poaching is focused on remote work opportunities.

- The travel sector is experiencing talent loss associated with employees choosing to return to school for upskilling opportunities.

These same employers have implemented new strategies to counter talent loss including:

- Re-recruiting: spending a lot of time with top talent and having transparent conversations about long-term goals, salary and why she/he would leave.

- Building a flexible, on-site culture and offering remote work.

- Hosting listening tours focusing greatly on diversity, equity and inclusion (DEI).

- Making aggressive talent decisions – customer service roles are the new software developer.

- Offering pro-active reviews, raises and spending a lot of time with new hires.

You can learn more about the top skills currently in demand in the region and the Talent Ecosystem Working Group by reading the Partnership’s new UpSkill Orlando report. More detailed economic data from this month’s job report can be found here.